This blog aims to provide relevant information about the Circle Rates in South Delhi.

Circle Rates are the minimum property rates for the valuation of Land and Immovable Properties for the purposes of registration. It is the minimum rate decided by the Government below which the property cannot be registered.

Delhi neighborhoods are classified into different categories from A-H for the purposes of calculation of Circles Rates.

MINIMUM LAND RATES FOR RESIDENTIAL PROPERTIES

| Category of Locality | Minimum Land Rates (Rs. Per Sq Mtr) | Minimum Rates of construction (Rs. Per Sq Mtr) |

| A | 774000 | 21960 |

| B | 245520 | 17400 |

| C | 159840 | 13920 |

| D | 127680 | 11160 |

| E | 70080 | 9360 |

| F | 56640 | 8220 |

| G | 46200 | 6960 |

| H | 23280 | 3480 |

CATEGORY-WISE CLASSIFICATION OF NEIGHBORHOODS

CATEGORY A

- JOR BAGH

- GOLF LINKS

- WESTEND

- SHANTI NIKETAN

- VASANT VIHAR

- ANAND NIKETAN

- CHANAKYAPURI

- FRIENDS COLONY

- MAHARANI BAGH

- PANCHSHILA PARK

- SUNDER NAGAR

CATEGORY B

- ANAND LOK

- DEFENCE COLONY

- NIZAMUDDIN EAST

- GULMOHAR PARK

- NEETI BAGH

- GREEN ARK

- HAUZ KHAS

- GREATER KAILASH

- PANCHSHEEL ENCLAVE

- S.D.A

CATEGORY C

- EAST OF KAILASH

- MALVIYA NAGAR

- NIZAMUDDIN WEST

- CHITTARANJAN PARK

- SAKET

- VASANT KUNJ

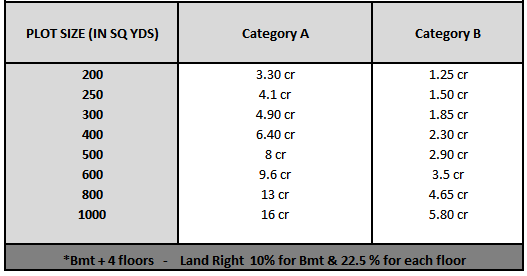

CIRCLE RATES IN SOUTH DELHI FOR BUILDER FLOORS (approx)

For Online Circle Rate Calculator – Click Here

Is it possible to sell a property below the Circle Rate?

Section 47-A of the Indian Stamp Act,1889 [as amended by the Indian Stamp (Delhi Second Amendment) Act, 2001] provides the procedure to be followed if the Instruments are under-valued.

Division Bench of the Hon’ble Delhi High Court, in Manu Narang & Anr v. The Lt. Governor, Government National Capital Territory Of Delhi And Ors, (2016) 226 DLT 1 (DB) observed as under:

In the event of the consideration mentioned in the instrument/transfer document presented for registration is less than the valuation as per the prescribed circle rates, the Registrar /Sub Registrar entrusted with the responsibility of registration of the documents, shall,

- notify the parties presenting the instrument/document for registration that the consideration set forth in the instrument and the stamp duty computed on the basis thereof is less than the valuation as per the circle rates;

- give them an opportunity to amend the document/instrument, to bring the valuation thereof for the purpose of payment of stamp duty, in consonance with the circle rates and makeup the deficiency in stamp duty;

- if parties do not amend/revise the valuation and do not pay the deficient stamp duty/transfer duty in terms of the circle rates, follow the procedure as prescribed in Section 47-A supra i.e. register the document/instrument (instead of returning the same to the parties) with the endorsement of registration and forward the same to the Collector of Stamps for determination of value or consideration as the case may be and the proper duty payable thereon; and

- the Collector thereafter shall proceed in accordance with law including Section 27 of the Stamp Act.

Division Bench of Hon’ble Delhi High Court in GNCTD Collector of Stamps v. CTA Apparels Pvt. Ltd.[LPA 278/2019 ] has held that the circle rate cannot be the only basis for fixing the stamp duty.

Brief facts of the case are as under

- The property in question was sold for ₹36,00,00,000/- against the valuation as per circle rate of ₹71,61,59,700/- Thus, there was a difference of ₹35,61,59,700/- in valuation as per circle rates and the stamp duty paid was ₹2,16,00,000/-

- The registering authority objected that there was undervaluation in the transaction.

The Hon’ble Court held as under:-

“Suffice it to say that the circle rates are not the only factors to be kept in mind by the Collector. The circle rate can be one of the factors to be kept in mind by the Collector for determination of the value under Section 47A of the Indian Stamp Act, 1899, especially, when the person who has approached for registration of the sale deed is disputing the valuation pointed out by the registering authority. In such an eventuality, detailed procedure ought to have been followed by the Collector as per Section 47-A(2) of the Act, 1899 keeping in mind the aforesaid aspects of the matter as well as the principles propounded by the Hon’ble Supreme Court, for determination of the value of the property. The mechanical approach of the Collector only to follow the circle rate is hereby deprecated.”

The Court also observed as under that:-

- Circle rate at the best can be one of the factors for determination of the valuation and nothing beyond that;

- Circle rate is nothing, but, a guidance given by the higher ranking Administrative Officer to the subordinate officer whenever any instrument comes up for registration under the Act. On the basis of this circle rate, the Registering Authority can, at best mechanically determine the valuation of the instrument, but, whenever the dispute arises, the exact market valuation, ought to be arrived at, by the Collector as mandated by Section 47A of the Act.

Circle rates cannot be mechanically followed by Collector, as a sole factor, to determine market value of the property in question.

The valuation of the property in question depends upon the varieties of factors like:

- The area of the plot in question or the property in question;

- The use of the property in question;

- Nature of property in question like new property and ten years old property.

- The width of the road upon which the property is situated;

- The nature of the adjacent properties;

- The nature of use of the adjacent properties, e.g., if an adjacent property is of a commercial nature, then the sale consideration fetched is bound to be different and if the adjacent property is a public convenience constructed by the Government, then the sale consideration fetched by the property in question can be entirely different.

- The existing market factors varies time to time, whereas, the circle rates are usually prescribed on a much prior point of time. In the facts of the present case, the circle rates were prescribed by the Government on 23rd September, 2014 whereas the sale deed has been entered into in the year 2016.

- The urgency of the sale by the owner of the property and if it is a distress sale.

- The need of the purchase of the property as, e.g., if the adjacent property owner wants to purchase at any cost the neighbouring property, the price the owner will fetch will be higher.

Tax liability on Sale of property below Circle Rates

As per Section 56(2)(x) of the Income Tax Act if the property is sold below the circle rate then the difference is taxed as “Other Income” of the Buyer and as per Section 50(c) the Seller will have to pay the Capital Gains on the circle rate of the property.

The Finance Act, 2020 provides that in case the difference between the Circle Rate and the actual consideration price is not more than 10%, the above Sections i.e. Section 50C and Section 56(2)(x) would not be applicable.

Compiled by: Rahul Vaed [B.Com (Hons), LLB (DU) ]

Disclaimer: The information provided above aims to provide helpful information on the subject discussed. The information is meant to serve as a general guide and not meant to be used, as the ultimate source of information and should not be construed as legal advice on any subject matter.

We disclaim all liability for actions you take or fail to take based on any content on this site. The author or the firm is not responsible to any person or entity with respect to any loss, incidental or consequential damage caused or alleged to have been caused, directly or indirectly, by the information or any omission thereof.

For Consultation you may contact the Author at +91 9971212323